September 2025 market update

Canada Life - Oct 07, 2025

Markets gained ground in September, lifted by rate cuts and easing inflation. Canadian and U.S. equities reached record highs, with materials leading performance. Gold rose, oil slipped.

Introduction

Global equity markets posted a gain over the month of September. Optimism towards risk assets was boosted as expectations grew that the U.S. Federal Reserve Board (Fed) was closing in on an interest rate cut. The Fed did lower interest rates at the end of September. Data still pointed to relatively shaky global economic conditions. While inflation has come down, the threat of upward pressure from tariffs persists. Meanwhile, the Bank of England, European Central Bank and Bank of Japan held their key policy interest rates steady in September.

In September, Statistics Canada reported that Canada’s gross domestic product expanded more than expected in July, before stalling in August, according to estimates. Inflation remained below the Bank of Canada’s (BoC) 2% target, while the unemployment rate ticked higher to its highest level since 2021. In response, the BoC lowered its key policy interest rate near the end of the month.

Interest rate cuts from the BoC and Fed helped bring down the yield on 10-year government bonds in Canada and the U.S. in September. The S&P/TSX Composite Index advanced and reached new record highs. The materials sector was the best-performing sector. U.S. equities also gained and recorded new record closing prices. The price of gold rose over September, while the price of oil finished lower.

Canada focused on diversifying trade

With trade tensions with the U.S. persisting, Canadian lawmakers got to work trying to enhance and nurture Canada’s trading relationship with other major economies around the world. One of the first stops was Mexico, where tensions had flared under the previous Canadian leadership. Prime Minister Mark Carney visited Mexican President Claudia Sheinbaum to improve relations, discuss Canada’s strong energy sector and coordinate plans as talks on the Canada-United States-Mexico Agreement will begin soon. At the United Nations General Assembly, Prime Minister Carney met with China’s Premier Li Qiang to discuss energy and agriculture trade between the two countries. Carney also expects to speak with China’s President Xi Jinping about trade and other key matters. Both countries have shared a contentious trade relationship in recent years, with high tariffs on canola and electric vehicles a sticking point to improved relations. Canadian lawmakers and business leaders are trying to diversify trade, as trade tensions with the U.S. persist. BoC Governor Tiff Macklem said this should have been done during the global financial crisis of 2008-09. At the time, Canada’s government committed to diversifying trade, but the plan was quickly pushed aside as U.S. domestic demand returned to more normal levels. Now, Canada’s economy is struggling amid trade disruptions. To help support the Canadian economy amid a soft labour market and contained inflation, the BoC lowered its key policy interest rate by 25 basis points (bps) to 2.50% at its September meeting. There is a strong likelihood the BoC will lower this rate again in 2025, particularly if trade tensions persist and weigh on Canada’s economic activity.

The U.S. Federal Reserve Board lowered interest rates

The Fed lowered the target range of its federal funds rate by 25 bps to 4.00%-4.25%. Markets predicted the rate cut after repeated signs of a slowing labour market and fragile economic activity in the U.S. This marked the Fed’s first rate cut in 2025, and the notes and comments from the Fed’s meeting in September suggest that more could be on the way. The Fed had held the federal funds rate steady over 2025 as it closely monitored the impact of tariffs on inflation and the economy. While there are some upside risks to inflation, labour markets have weakened and economic growth, while strong in the second quarter of 2025, was primarily due to a shift in trade activity. The U.S. economy grew by 3.8%, annualized, in the second quarter, which was its fastest pace of growth since the third quarter of 2023. At its September meeting, the Fed revised its economic projections. The Fed increased its projection for growth this year from 1.4% to 1.6%. The Fed also raised its projection for the U.S. unemployment rate, while expecting the personal consumption expenditure price index, the Fed’s preferred inflation gauge, to hover near 3% this year before falling to 2.6% next year. Fed officials expect two more interest rate cuts this year to help support the economy and the lacklustre labour market.

China’s key economic indicators slow

China’s economy continues to show signs of fragility, with several key indicators pointing to a need for increased government and central bank support to stimulate growth. Domestic demand remains a central concern. Retail sales rose by 3.4% year-over-year, which was a slowdown from the 3.7% increase in July. This marked the slowest pace of growth since November 2024. Spending on food, household appliances and furniture slowed noticeably. External demand also weighed on performance. Export growth slowed to 4.4% year-over-year, largely in response to a 33% decline in exports to the U.S. On the production side, industrial production rose by 5.2% year-over-year compared to 5.7% in the previous month. At its September meeting, the People’s Bank of China (PBOC) held its one- and five-year loan prime rates steady at 3.00% and 3.50%, respectively, but pledged to provide more support if needed. Should lacklustre economic conditions persist, more support from the PBOC and government may be warranted.

More records for gold prices

The price of gold kept reaching new record highs throughout September. With the global economy gripped with uncertainty amid trade disruptions, geopolitical tensions and a clouded outlook for inflation, investors have turned to gold as a safe-haven asset. Several factors helped push up the price of gold in September, the first of which is ongoing economic uncertainty. In times of uncertainty, demand for gold increases, which helps push up prices. As the month progressed, expectations rose that the Fed would lower interest rates at its September meeting, which could add to inflationary pressures. Meanwhile, the U.S. dollar has weakened over concerns about trade tensions and the U.S. economy. Gold also got a boost when reports surfaced that China was considering becoming a depository for foreign sovereign gold reserves. The Canadian gold mining industry, which is a major player in the global market, benefited from higher gold prices. And this has been reflected in the stock prices of materials sector companies, which rose by 19% in September and 78% year-to-date. The price of gold rose by 12% over September, finishing over US$3,800 per ounce for the first time ever.

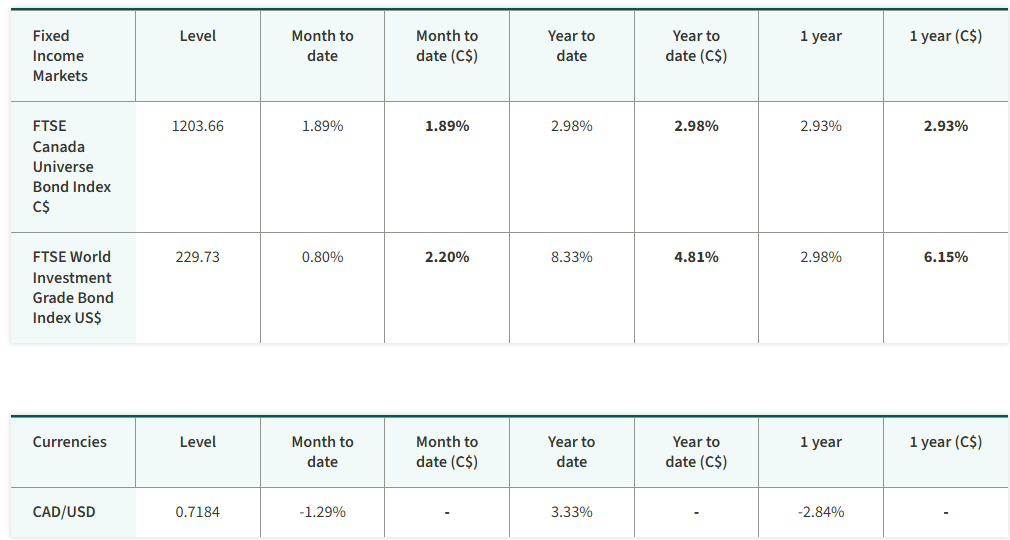

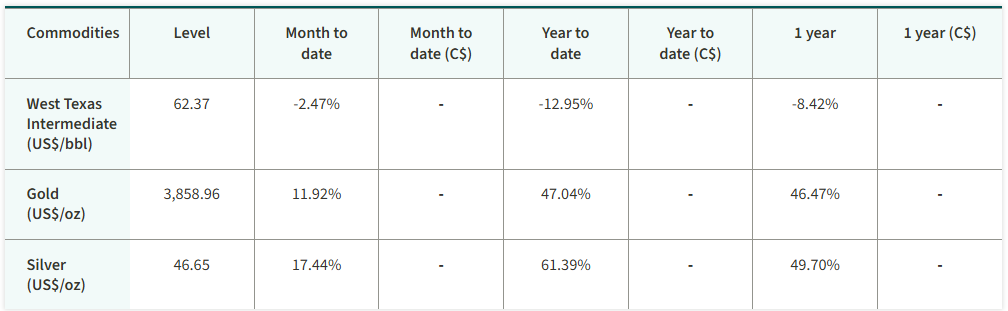

Market performance - as of September 30, 2025